chapter 7 bankruptcy No Further a Mystery

If you can’t do this, your case can be delayed until you'll be able to and will be dismissed For anyone who is not able to provide or offer you transcripts of the returns.

The Value to file Chapter thirteen bankruptcy includes a $313 filing fee and fees charged by a bankruptcy attorney. As for files along with other data, you will need to offer:

Discover an authorised credit rating counselor to help you weigh your options. If you choose to move forward with bankruptcy, you can employ a bankruptcy attorney that will help you fill out the paperwork.

Usually, your tax refund may be viewed as section of your respective bankruptcy estate, likely used to repay creditors. This prospect can be regarding, as tax refunds frequently depict an important sum a large number of count on for money relief or significant buys.

The technical storage or entry is strictly essential for the respectable purpose of enabling the use of a specific company explicitly requested via the subscriber or person, or for the sole function of finishing up the transmission of the communication about an electronic communications network.

Non-Dischargeable Debts: In the event the IRS garnishment is for a non-dischargeable debt, including particular different types of taxes, penalties, or taxes for which a return was in no way filed or submitted fraudulently, the IRS can likely resume garnishment once the bankruptcy situation is concluded.

When a person files for bankruptcy, a independent taxable entity, often called a bankruptcy estate, is developed. This entity is liable for paying taxes his comment is here on earnings it receives following the bankruptcy filing.

Legal and Specialist Costs: Should you incur lawful or other professional service fees associated with your bankruptcy, these are definitely commonly not deductible on your own tax return.

Professional Bono is normally utilized for absolutely free or low-Expense Specialist legal solutions. During the US, all attorneys are advised below moral rules to add at the very least fifty several hours to Professional Bono solutions so as to help Individuals in will need. Discover nearby Professional Bono workplaces for very affordable authorized enable.

With the assistance of your more courtroom, you and your creditors will design a repayment plan that lasts from a few to 5 years. Once the choose approves your proposal, you will deliver regular payments to a court-appointed trustee. They will collect and distribute your go payments on your creditors with the period of your respective settlement. Soon after, any remaining debts are discharged. Advantages of filing for Chapter 13 bankruptcy

Skipped bankruptcies equate to dropped earnings. Meanwhile, mistakenly dealing with a buyer as bankrupt hurts client associations and dig this it is bad for company.

Given the complexity of bankruptcy and tax legislation, consulting which has a bankruptcy attorney or tax Expert is commonly advisable. These specialists can offer steering tailor-made in your circumstance and make it easier to navigate the intricacies of bankruptcy and tax obligations.

If it seems that some or all of the refund will be at risk, you may i thought about this simply hold out and file your bankruptcy once the tax refund has been been given and spent down.

Before filing for bankruptcy, it is important to fully comprehend the nature of your tax personal debt. As not all tax debts is often discharged in bankruptcy, knowing which debts you've got might help notify your choice.

Angus T. Jones Then & Now!

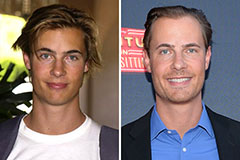

Angus T. Jones Then & Now! Erik von Detten Then & Now!

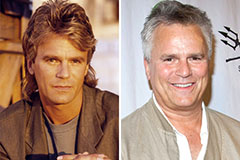

Erik von Detten Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!